In our previous communications we have sought to highlight the risks and opportunities associated with running a traditional company car benefit programme: - We focussed on the key cost drivers and looked at strategic changes that could be made to place downward pressure on rising costs.

Critical in our focus was the increasing burden of National Insurance & Benefit in Kind charges combined with rising fuel costs - and how these impact fleet costs.

Critical in our focus was the increasing burden of National Insurance & Benefit in Kind charges combined with rising fuel costs - and how these impact fleet costs.

How to Save with Salary Sacrifice/Exchange

In this, our final communication prior to the CFO forum we review an option that will allow you to take advantage of these increasing costs. We consider how employers can produce substantial savings on the PAYE bill and at the same time improve the overall benefits package to your employee base through the introduction of a company car salary exchange programme for your wider employee base – not just those who currently receive a company car benefit.

Salary Sacrifice/Exchange schemes have been available in the market for several years now and have become of increasing interest to companies looking to provide flexible benefits to their employees.

A sacrifice/exchange happens when an employee gives up the right to receive part of cash pay and, in return, receives a non-cash benefit: in this case a Company Car. The sacrifice is achieved by varying employee terms and conditions relating to pay.

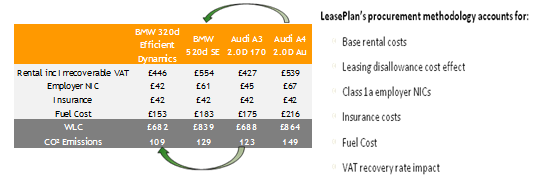

The schemes work on the basis that the employee exchanges gross salary in return for a company car which leads to savings of tax and NI contributions on the salary sacrificed. However, this is off-set by benefit in kind tax on the company car. Overall the Company will secure savings as the cost of providing the employee with a company car is less costly than the alternative cost of providing the pre-sacrificed salary.

The schemes work on the basis that the employee exchanges gross salary in return for a company car which leads to savings of tax and NI contributions on the salary sacrificed. However, this is off-set by benefit in kind tax on the company car. Overall the Company will secure savings as the cost of providing the employee with a company car is less costly than the alternative cost of providing the pre-sacrificed salary. Recent changes in tax and the introduction of more premium vehicles under the 120g/km BIK threshold have assured that benefits available now are far greater than has previously been the case.

Benefit for Employees

The benefit for employees is evident. For the employer it will depend upon the level of take up across your employee base - typically 3-10%. With a minimum employer saving of £391 per vehicle the level of savings achievable are set out as follows.

Evidently these values and outcomes will vary between employers and will be affected by the approach to risk and benefits that each employer would adopt. It is also a fact that not all organisations are suitable for such schemes. Any decision to offer a company car salary exchange scheme must be preceded by rigorous feasibility & scheme design activities and the production of a robust business case. LeasePlan is well placed to undertake such activity on your behalf based on our past experience.

A Salary Sacrifice scheme is one of the few genuine triple win solutions you might provide in your organisation:

Evidently these values and outcomes will vary between employers and will be affected by the approach to risk and benefits that each employer would adopt. It is also a fact that not all organisations are suitable for such schemes. Any decision to offer a company car salary exchange scheme must be preceded by rigorous feasibility & scheme design activities and the production of a robust business case. LeasePlan is well placed to undertake such activity on your behalf based on our past experience.

A Salary Sacrifice scheme is one of the few genuine triple win solutions you might provide in your organisation:

• Profit – with the right design you will reduce your PAYE costs year on year.

• People – every employee can secure a valuable added benefit that saves them tax and NIC

• Planet – with the right design you will see older polluting vehicles replaced with new, CO2 efficient alternatives.

As this is our last publication leading up to the CFO forum we would like to thank you for reviewing the information we have provided so far: There are many opportunities to make significant inroads into reducing fleet costs and enhancing employee benefits. Careful policy design which best leverages the effects of the UK taxation regime – both at the corporate level and for the individual employee – is at the heart of the matter.

We have only been able to provide a ‘flavour’ of the many opportunities within these communications.

Our consulting team will be attending forum and look forward to meeting you person. We hope to discuss your current strategy, to offer an insight into measures to enhance it and to show how LeasePlan will be able to support your plans.

Our consulting team will be attending forum and look forward to meeting you person. We hope to discuss your current strategy, to offer an insight into measures to enhance it and to show how LeasePlan will be able to support your plans.

Lesley Slater: Brand Director LeasePlan